Pull Back Alert

The Pull Back Alert indicator

is based on the Volume Spread Analysis technique of chart

analysis.

Volume Spread

Analysis (VSA) is a form of technical analysis which attempts to look

into price action in

relation to volume. VSA is the study of the market forces of supply

and demand and the manipulation of those forces through the

psychology of crowd behavior, through examining the relationship

between the quantity of volume on a price bar, the spread of the

price or range of the bar, and the closing price on the height of

that bar. Studying these variables establishes the equilibrium of

demand and supply as well as the likely near term direction of the

market.

Rediscover the Lost Art of

Chart Reading

Using Volume Spread

Analysis

Credit To: Todd

Krueger

Most traders are aware of the two widely known

approaches used to analyze a market, fundamental analysis and

technical analysis. Many different methods can be used in each

approach, but generally speaking fundamental analysis is concerned

with the question of why something in the market will happen, and

technical analysis attempts to answer the question of when

something will happen.

There is, however, a third approach to

analyzing a market. It combines the best of both fundamental and

technical analysis into a singular approach that answers both

questions of “why†and “when†simultaneously; this

methodology is called volume spread analysis. The focus of this

article is to introduce this methodology to the trading community,

to outline its history, to define the markets and timeframes it

works in, and to describe why it works so well.

What is Volume Spread Analysis?

Volume spread analysis (VSA) seeks to

establish the cause of price movements. The “cause†is quite

simply the imbalance between supply and demand in the market, which

is created by the activity of professional operators (smart money).

Who are these professional operators? In any business where there

is money involved and profits to make, there are professionals.

There are professional car dealers, diamond merchants and art

dealers as well as many others in unrelated industries. All of

these professionals have one thing in mind; they need to make a

profit from a price difference to stay in business. The financial

markets are no different. Doctors are collectively known as

professionals, but they specialize in certain areas of medicine;

the financial markets have professionals that specialize in certain

instruments as well: stocks, futures, forex, etc.

The activity of these professional operators,

and more important, their true intentions, are clearly shown on a

price chart if the trader knows how to read them. VSA looks at the

interrelationship between three variables on the chart in order to

determine the balance of supply and demand as well as the probable

near term direction of the market. These variables are the amount

of volume on a price bar, the price spread or range of that bar (do

not confuse this with the bid/ask spread), and the closing price on

the spread of that bar.

With these three pieces of information a

properly trained trader will clearly see if the market is in one of

four market phases: accumulation (think of it as professional

buying at wholesale prices), mark-up, distribution (professional

selling at retail prices) or mark-down. The significance and

importance of volume appears little understood by most

non-professional traders. Perhaps this is because there is very

little information and limited teaching available on this vital

part of chart analysis. To interpret a price chart without volume

is similar to buying an automobile without a gasoline tank. For the

correct analysis of volume, one needs to realize that the recorded

volume information contains only half of the meaning required to

arrive at a correct analysis. The other half of the meaning is

found in the price spread (range).

Volume always indicates the amount of activity

going on, and the corresponding price spread shows the price

movement on that volume. Some technical indicators attempt to

combine volume and price movements together, but this approach has

its limitations; at times the market will go up on high volume, but

it can do exactly the same thing on low volume. Prices can suddenly

go sideways, or even fall off, on exactly the same volume! So there

are obviously other factors at work on a price chart. One is the

law of supply and demand. This is what VSA identifies so clearly on

a chart: An imbalance of supply and the market has to fall; an

imbalance of demand and the market has to rise.

A Long and Proven Pedigree

VSA is the improvement upon the original

teaching of Richard D. Wyckoff, who started as a stock runner at

the age of 15 in 1888. By 1911, Wyckoff was publishing his weekly

forecasts, and at the height of his popularity, it was rumored that

he had over 200,000 subscribers. In 1931 he published his

correspondence course, which is still available today. In fact, the

Wyckoff method is offered as part of the graduate level curriculum

at the Golden Gate University in San Francisco. Wyckoff is said to

have disagreed with market analysts who traded from chart

formations that would signal whether to buy or sell. He estimated

that mechanical or mathematical analysis techniques had no chance

of competing with good training and practiced judgment.

Tom Williams, a former syndicate trader

(professional operator in the stock market) for 15 years in the

1960s-1970s, enhanced the work started by Wyckoff. Williams further

developed the importance of the price spread and its relationship

to both the volume and the close. Williams was in a unique

situation that allowed him to develop his methodology. He was able

to monitor the effects of the syndicate’s trading activity on the

price chart. As a result, he was able to discern which resulting

price gyrations derived from the syndicate’s action on the

various stocks they were buying and selling. In 1993, Williams made

his work available to the public when he published his methodology

in a book titled Master the Markets.

A Universal Approach

Just as Wyckoff’s approach was universal in

its application to all markets, the same is true of VSA. It works

in all markets and in all timeframes, as long as the trader can get

a volume histogram on the chart. In some markets this will be

actual traded volume, as it is with individual stocks, yet in other

markets the trader will need access to tick-based volume, as is the

case with forex. Because the forex market does not trade from a

centralized exchange, true traded volume figures are not available,

but this does not mean that the trader cannot analyze volume in the

forex market, it simply requires that tick-based volume be used

instead.

Think of volume as the amount of activity on

each individual bar. If there is a lot of activity on that price

bar, then the trader objectively knows that the professional

operator is heavily involved; if there is little activity then the

professional is withdrawing from the move. Each scenario can have

implications to the supply/demand balance on the chart and can help

the trader determine the direction the market is likely to move in

the short to medium term. A forex example will be shown later in

this article. Just as VSA is a universal approach to all markets,

this methodology works equally well in all time frames. It makes no

difference if the trader is looking at a 3-minute chart, or if

daily or weekly charts are being analyzed—the principles involved

remain the same. Obviously, if supply is present on a 3-minute

chart, the resulting downward move will be of a lesser magnitude

than supply showing itself on a weekly chart, but the result of

excess supply on a chart is the same in both instances; if there is

too much supply, then the market must fall.

Why it Works

Every market moves on supply and demand:

Supply from professional operators and demand from professional

operators. If there is more buying than selling then the market

will move up. If there is more selling than buying, the market will

move down. Before anyone gets the impression that the markets are

this easy to read, however, there is much more going on in the

background than this simple logic. This is the important part of

which most non-professional traders are unaware! The underlying

principle stated above is correct; however, supply and demand

actually work in the markets quite differently. For a market to

trend up, there must be more buying than selling, but the buying is

not the most important part of the equation as the price rises. For

a true uptrend to take place, there has to be an absence of major

selling (supply) hitting the market. Since there is no substantial

selling to stop the up move, the market can continue

up.

What most traders are completely unaware of is

that the substantial buying has already taken place at lower levels

as part of the accumulation phase. And the substantial buying from

the professional operators actually appears on the chart as a down

bar/s with a volume spike. VSA teaches that strength in a market is

shown on down bars and weakness is shown on up bars. This is the

opposite of what most traders think they know as the truth of the

market. For a true downtrend to occur, there must be a lack of

substantial buying (demand) to support the price. The only traders

that can provide this level of buying are the professional

operators, but they have sold at higher price levels earlier on the

chart during the distribution phase of the market. The professional

selling is shown on the price chart during an up bar/s with a

volume spike, weakness appears on up bars. Since there is now very

little buying occurring, the market continues to fall until the

mark down phase is over. The professional operator buys into the

selling that is almost always created by the release of bad news;

this bad news will encourage the mass public (herd) to sell (almost

always for a loss). This professional buying happens on down bars.

This activity has been going on for well over 100 years, yet most

retail traders have remained uninformed about it—until

now.

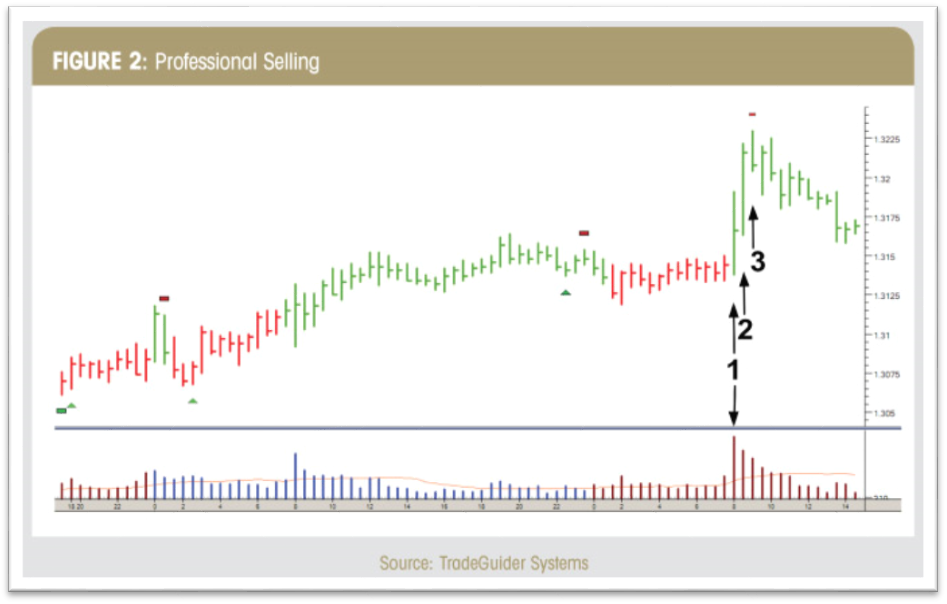

VSA at Work

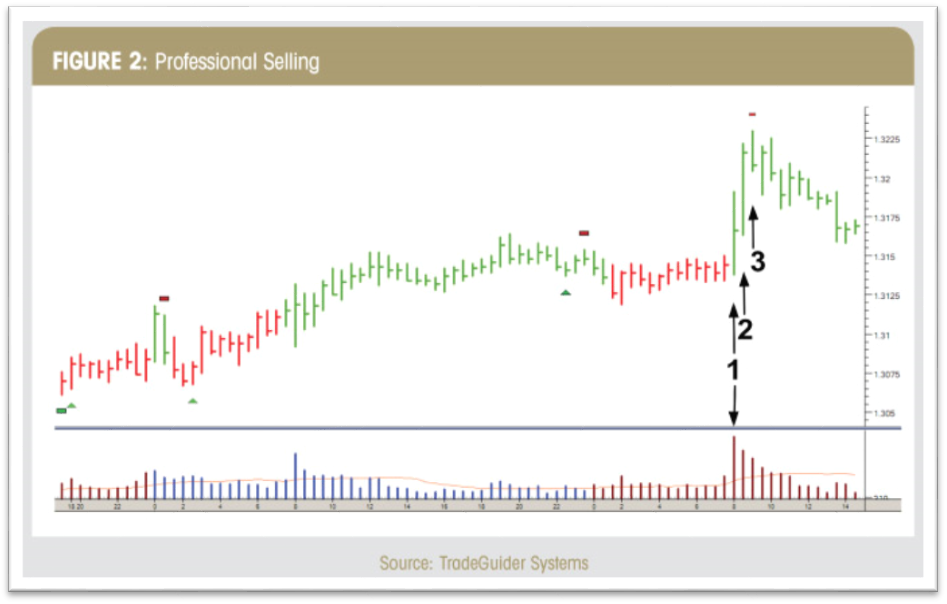

Let’s now look at a clear example of supply

entering a market as the professional operators are selling into a

rising market. Please see Figure 2 as we look at the U.S.

dollar/Swiss franc spot forex market on a 30-minute price chart.

This market was in the mark-up phase until the bar labeled 1;

notice the massive volume spike as an ultra wide spread, up bar,

appears with the price closing in the middle of the bar. This is a

telltale sign of professional selling entering the market; a trader

must look at this bar and realize that if all the activity shown on

the volume histogram represented buying, we could not possibly have

the price close on the middle of the bar. Because professional

operators trade with very large size, they have to sell into up

bars when the herd is buying; this is how they unload their large

size onto the unsuspecting public. Many times, these types of bars

are created from news reports that appear very bullish to retail

traders and invite their participation on the long side of the

market. When this occurs, it creates the opportunity for

professional operators to systematically sell their holdings and

short the market, without driving the price down against their own

selling.

A properly trained trader understands

instantly that when the bar closes in the middle like this, with

massive volume, it signifies a transfer of ownership from the

professionals to what VSA refers to as “weak holders,†traders

that will soon be on the wrong side of the trade. Think of the

analogy used earlier in this article; this is the professional

operators “selling at retail†(distribution) when earlier they

established their positions by “buying at wholesaleâ€

(accumulation). On the bar labeled 2, again we have more selling

from the professionals as they complete the transfer of ownership

to weak hands. The trained trader can see this as the bar labeled 3

is now closing lower, confirming that there was a large block of

selling on the previous bar.

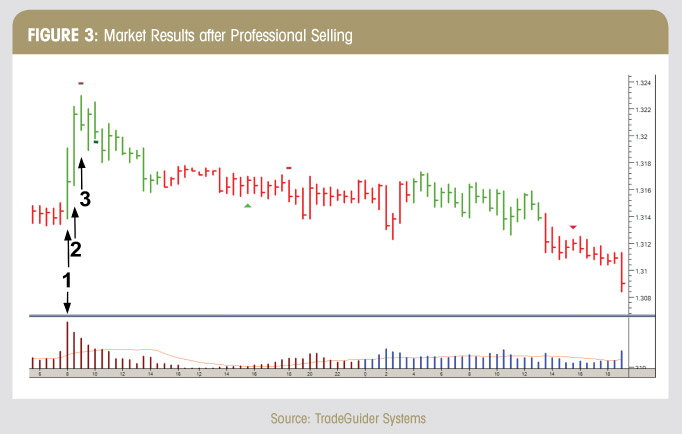

Don’t Be Part of the Herd

Let’s review what just happened on the price

chart here. The professional money has sold their holdings to the

mass public called the “herd†or “weak holders.†The

professionals sold short and the new buyers are locked into a poor

position. How can price continue higher when the professional money

won’t support higher prices and there are no other buyers left to

buy? With no buyers left to support the price, the price falls as

the chart continues on into the mark down process (see Figure 3).

To explain why prices fall in any market, let’s refer to a

previous statement: “For a true downtrend to occur, there must be

a lack of substantial buying (demand) to support the price. The

only traders that can provide this level of buying are the

professional operators, but they have sold at higher price levels

earlier on the chart, during the distribution phase of the

market.â€

When the price falls far enough, the

professional operator will now enter the market and buy (at

wholesale levels) from the “weak holders,†who are forced to

sell at a substantial loss, and the cycle will repeat itself over

and over again. This is the way all markets work! Because

professional operators specialize in many different markets and

many different time frames, this same sequence of events unfold on

price charts of all durations. We reviewed a 30-minute chart in

this article, but it could just as easily have been a weekly chart.

The market we looked at was forex, but volume spread analysis works

just as well in stocks, futures and commodities. VSA is a market

analysis methodology that alerts the trader to the two most

important questions that they must know the answers to in order to

trade successfully — why and when. Why markets move is based on

the supply and demand from professional operators, and when they

move can be expanded upon once the trader has a more thorough

understanding of volume spread analysis.

HUD (Heads Up Display)

With all of our Intentional

Indicators our attempt is to remove all extraneous information, and

to put the information that we really need for making trade

decisions right in front of us on our charts. This is the “HUDâ€

or “Heads Up Display†approach we take with each of our

indicators. This approach to developing our indicators creates much

cleaner, neater charts and keeps the trader from having to look

away from his or her target in order to make a good trade decision.

It simplifies every trade decision so that they can be made quickly

and accurately.

Figure 1 on the main chart area the

PullBackAlert indicator has generated custom draw objects when

the

conditions required to

generate a signal are present. The histogram below is the

PullBackAlertLevel indicator.

For our purposes, we are

simply looking for an indication that price is showing a potential

reversal or pullback from a trend according to an underlying set of

data. It is not important to watch this data in order to determine

if a condition does or does not exist. We simply need to keep our

eyes on our charts and only the necessary information will be used

to alert us to the fact that a condition exists. Therefore the need

for multiple charts, monitors, computers, and indicators is greatly

diminished.

PullBackAlert ships with 2

different indicators that can be applied to a chart.

- PullBackAlert

- PullBackAlertLevel

The first indicator will

generate draw or text objects on a chart to indicate when a

condition is present. This object will print on the close of the

current bar only if the parameters that have been set indicate a

positive condition is present, and will print either above or below

the bar. If it prints above the bar, then a reversal or pullback

sell (short) could be anticipated. If it prints below the bar, then

a reversal or pullback buy (long) could be anticipated.

This indicator is the only

one of the two included that we use in The Intentional Trader trade

rooms. If a trader chooses, he or she could also add the

PullBackAlertLevel indicator to the chart. To get an accurate

picture of what is happening, it is important that the parameter

settings of each indicator are identical to each other.

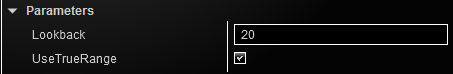

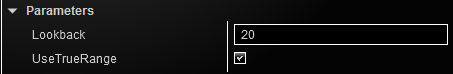

Parameter Settings

LookBack

The number of bars to look

back to determine min/max values

UseTrueRange

Use the actual range of the

bar or just the high/low of the bar.

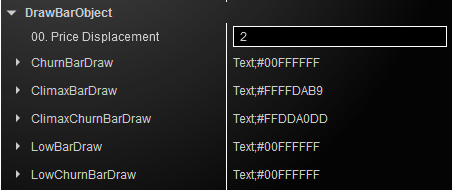

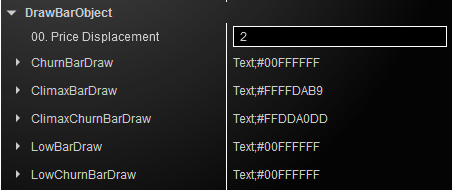

Draw Bar Object

Settings

The user has the ability to

use any NinjaTrader drawing object such as dots, arrows, or

triangles as well as using any text to customize how the indicator

appears on the chart.

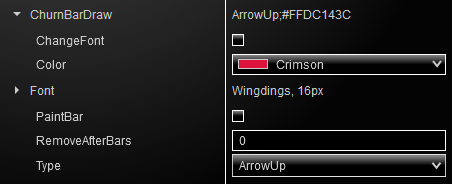

ChurnBar: Churn bars indicate profit taking, new supply entering

the market at tops or new demand entering the market at

bottoms

ClimaxBar: Climax Up bars indicate large volume demand that results

in bidding up prices. Climax Down bars indicate large volume supply

that results in pushing down prices.

ClimaxChurBar: A combination

of the ClimaxBar and ChurnBar

LowBar: Low bars indicate a lack of demand at the tops or a lack

of supply at the bottoms.

Price Displacement

This is the distance from the

top or bottom of the bar that the draw object will print. The lower

the number the closer to the top or bottom of the bar it will

print.

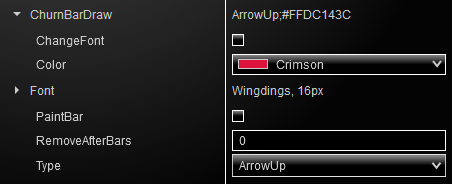

*BarDraw Parameters

Click the “>†sign

next to any of the BarDraw menu items to set the parameters of the

drawing object that prints on the chart to indicate a positive

condition.

This will open up some

selections where you can choose the parameters of the look and

actions of the draw object.

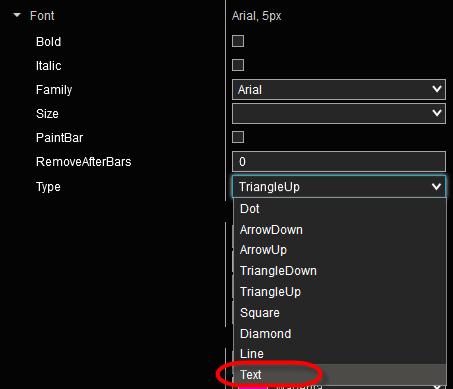

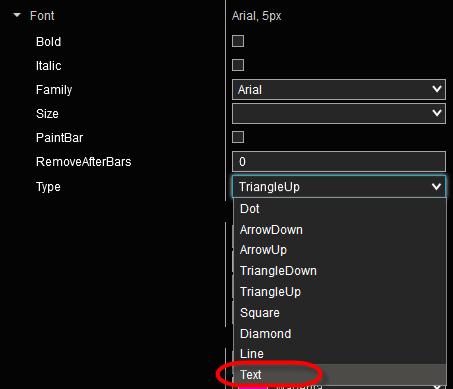

ChangeFont

(see below, Using

Fonts)

Color

Choose from any of the

NinjaTrader default color selections

Font (see below, Using

Fonts)

PaintBar

If you do not want to print a

draw object on your chart, you can choose to have the entire bar or

candlestick paint a color to indicate that a positive condition

exists. Selecting this checkbox will override any other

settings.

RemoveAfterBars

Number of bars after the bar

on which the draw object printed that the draw object will be

removed from the chart.

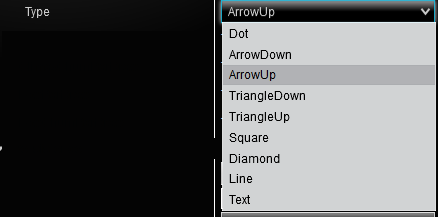

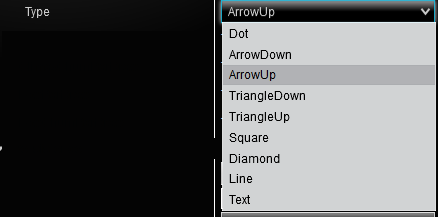

Type

Using Fonts

Select the draw object or

“Textâ€.

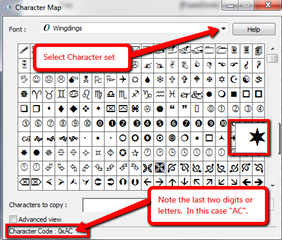

Steps required to change to a

custom printed character:

For illustration, let’s

say the user prefers a star rather than an arrow or other draw

object. How do we display a star on the chart? Follow

the steps below:

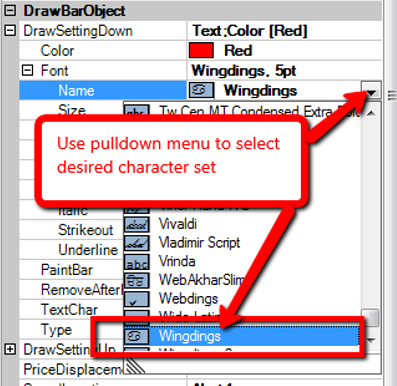

- To change to a new custom symbol, select “Text†in the

PullBack Alert indicator settings under DrawBarObject.

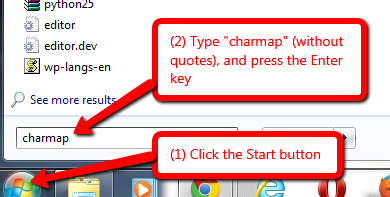

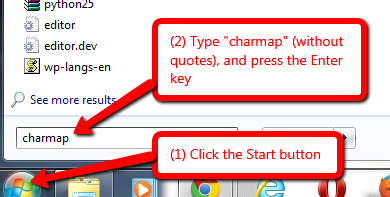

- To view and choose a character set, click on the Windows

Start button. Type charmap

and press Enter.

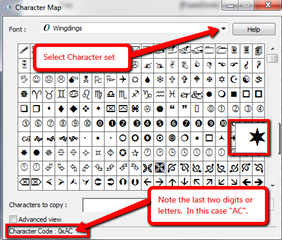

- This last step will bring up all the character sets

available on the local computer. Browse through the options

such as Webdings, Wingdings, or other graphical or text

characters.

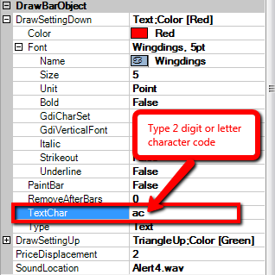

- For example, let’s say the user wants a star from the

Wingdings set. Make a note of two pieces of information: (1)

that it is in the Wingdings set; and (2) that the character code

ends in “ACâ€.

- Next, go back to the PullBack Alert indicator settings in

NinjaTrader. Under Font Name, use the pulldown menu to select

the character set from Step 4. For our example, we select

“Wingdings.â€

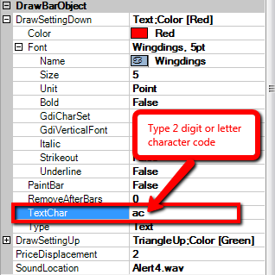

- From Step 4 above, type in the two digit or letter

character code for the particular character that was chosen from

the character set. This is entered in the PullBack Alert

indicator settings under the TextChar settings as shown to the

right.

In this example, we would

type ac (not case sensitive) in the TextChar box in order to get

the Wingdings star.

From here, the user can

select the size and color of the chosen symbol.