NRSZone for Ninjatrader 8

In our 2nd Brain Trading, the potential for price exhaustion is a major qualifying factor in determining the highest probability trade setups. The higher the potential of exhaustion, the more likely price is going to soon stop and head in the other direction. For 2nd Brain Traders, “The Other Direction” is our edge in trading the markets.

In our RockStar trade setup, a major line of support or resistance is needed 5 ticks or less behind a trade entry to help to slow price down if the trade begins to go against us. This rule works very well, but limits our trade setups to be taken only when a major line of support or resistance is nearby. Over the years, we’ve watched thousands of potential trades that do not have the support/resistance lines nearby, become winners. Some traders decided to start taking trades without these lines to offer some protection and they did very well with them. They became known as “Naked” trades. Trades that do not have the cover of S/R lines.

Over time, it seemed that these trades rarely need the cover of S/R to be profitable, but we needed to add more confluence of potential exhaustion indicators to maintain the edge enjoyed by the regular RockStar trade setup. That’s why we developed the NRSzone indicator (Naked RockStar zone). Coupled with several of our other indicators, this indicator will show when price has broken out of a zone (channel, tight range) and indicate that the breakout could lead to exhaustion, at least in the short term.

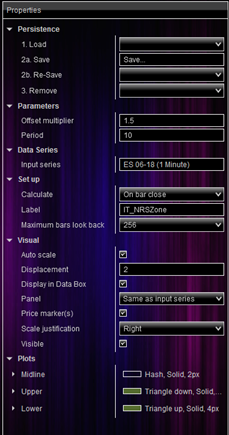

The settings in the NRSzone indicator are similar to what you find in other volatility based envelopes such as Bollinger Bands and Keltner channels that use ATR and Standard deviations to develop the distance between upper and lower extremes.

Use the Period and Offset Multiplier parameters to determine the range for required for a breakout determination. The settings in the NRSzone are considered the default average that most users would use.